How Much Should Taxpayers Pay for a Private Museum? A French Watchdog Group Files a Claim to Find Out

A Paris museum is locked in a battle with a French watchdog organization over allegations of tax fraud.

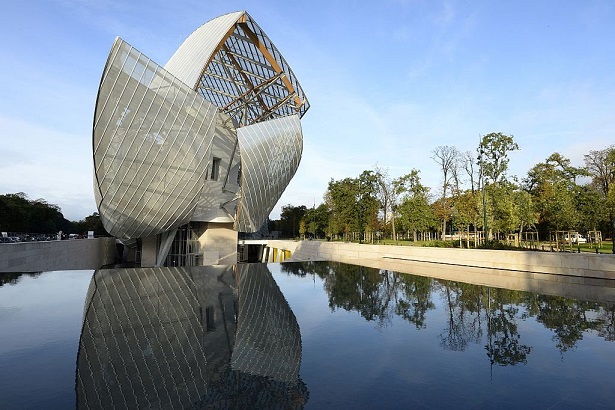

Photo: BERTRAND GUAY/AFP/Getty Images.

The Louis Vuitton Foundation in Paris has been called a “gift to France.” But according to some critics, the private museum founded by billionaire art collector Bernard Arnault was a gift that came at a spectacular cost to French taxpayers. Now, an anti-corruption group has filed a complaint accusing the foundation of fraud and tax evasion in the Court of Auditors in Paris, France’s financial taxation watchdog.

The final construction cost of the Frank Gehry-designed building on the edge of Paris was nearly €790 million (around $900 million), according to French media, seven times the original estimate when Arnault first announced the project. This figure has been revised significantly upward since the museum first opened in 2014. At that time, the New York Times reported that the cost was closer to $135 million. (The foundation declined to comment to artnet News about the final cost.)

The watchdog group, Front républicain d’intervention contre la corruption (FRICC), filed its complaint against the museum on November 15. It estimates that Arnault’s company LVMH has unfairly benefited from tax breaks to the tune of hundreds of millions of euros a year over the past decade. “The National Financial Prosecutor’s Office should launch a preliminary investigation,” Jean-Luc Touly, the president of FRICC, tells artnet News. (The FRICC’s complaint was first reported by Liberation.)

After news of the complaint surfaced, the luxury brand conglomerate shot back, refuting the allegations and stating that it “was clearly written with the sole purpose of damaging the reputation of the Fondation Louis Vuitton and the LMVH Group.” In a statement provided to artnet News, a representative for the foundation said it “has decided to sue the authors of this complaint for slander and to claim damages and interest corresponding to the media damage it has consequently suffered.” The spokesperson added that the report is “completely without foundation.”

“We can only imagine that the success of the Louis Vuitton Foundation unsettles some people,” she said, adding that it is one of the most frequented exhibition spaces in Paris and has welcomed more than 5 million visitors since it opened in 2014.

A Bigger Problem

The dispute stems in part from growing dissatisfaction with France’s generous corporate philanthropy law, which allows a company to deduct 60 percent of the sum it gives to cultural projects and institutions from its corporate tax bill. The so-called “Aillagon” law is named after the former minister of culture Jean-Jacques Aillagon, who championed the tax break. (프랑스의 기업자선사업법은 문화기관의 법인세 60퍼센트를 공제해 주도록 하고있다. (소위 아일라곤법) 이법을 활용해 세금면세혜택을 받은 기업의 수는 2005년 6500건에서 2017년 68,930 건으로 증가했다. Some French politicians have recently called for a rollback of the law, which they regard as a tax loophole. The number of corporations that took advantage of the law has grown from 6,500 in 2005 to 68,930 in 2017, according to Le Monde.

In response to the scrutiny, the Court of Auditors released a more than 100-page report this week on corporate sponsorship in France. The Fondation Louis Vuitton was one of three foundations in different fields that were assessed in-depth.

The report found that the art foundation benefitted from €518.1 million ($589 million) worth of tax cuts for its first 11 financial years, or an average of €47.1 million ($53.5 million) per year. That represents around 8.1 percent of the total tax breaks provided by the state to corporate philanthropists during that period. The report concluded that tax benefits were disproportionately enjoyed by a small number of corporate foundations, and suggested that the government consider reforming its tax system to more broadly distribute benefits and limit the load on the taxpayer.

In a statement, a spokesperson for the Louis Vuitton Foundation maintained that the report by the Court of Auditors did not criticize the foundation itself. “For the record, the report of the Court of Auditors on corporate patronage has, after a long and detailed investigation, specified that the Louis Vuitton Foundation does not call for any observations as to its regularity or legality.”

The Fondation Louis Vuitton’s 126,000-square-foot building, which is topped off by monumental sail-like panels made with glass and steel, has developed a reputation for ambitious blockbuster exhibitions. Since its launch five years ago, the foundation has displayed contemporary art from LVMH and Arnault’s collection, as well as high-profile (and pricey) loan exhibitions of works that rarely travel, including the Shchukin Collection from Russia and highlights from the Museum of Modern Art in New York. Currently, the museum is hosting exhibitions of Jean-Michel Basquiat and Austrian painter Egon Schiele.

The museum, which stands on a public park, is due to revert to the City of Paris in 50 years.